Audiobooks: how Storytel tuned up for its next step

After a period of retrenchment, Storytel has its sights set on market growth. CEO Bodil Eriksson Torp and chief content and publishing officer Helena Gustafsson explain the company’s plans for the future.

In 2016 The Bookseller ran a profile on Storytel, the Sweden-based audiobook retailer, describing its growth and dominance of the listening sector in its native country as happening “more or less in secret”. The business had been founded in 2005 by Jonas Tellander and Jon Hauksson, but neither considered themselves book people and they marketed Storytel to investors as a tech company. Their success was helped by the arrival of the smartphone, fellow tech company Spotify and just a little stealth.

Twenty years later, the secret is well and truly out, and Storytel’s own tale of rapid growth is now well-known, alongside its ambitious all-you-can-eat streaming model that won fans among listeners but caused concern for publishers. Tellander, who had been CEO, left in 2022 saying that “all my wildest dreams about Storytel have come true”. The wake up was that the business also had to make money. Veteran media executive Johannes Larcher took over as CEO and shortly thereafter announced that the business would “sharpen” its focus on profitability and cash flows, with the result that 13% of its total workforce exited the company.

Today, Storytel operates in 25 markets, with a focus on 10 core markets: the five Nordic countries, the Netherlands, Turkey, Poland, Bulgaria and the US. It has three retail brands: Storytel, e-book vendor Mofibo and the US-based Audiobooks.com, as well as audiobook publisher Storyside, and it owns 11 traditional book publishers managed by Storytel Books, including Norstedts, one of Sweden’s oldest and most respected publishing houses.

It has a new CEO, too, Bodil Eriksson Torp, a former Bonnier executive whose mission is to put the business back on a (stable) front foot. The top team includes Helena Gustafsson, chief content and publishing officer, who is an older hand in the c-suite, having joined the business when it bought Storyside in 2013.

“It was a huge effort,” says Eriksson Torp, who joined after the turnaround. “We’d planted a flag in those 25 markets and grew the subscriber base, but then we transitioned, focusing instead on profitable growth and stability.”

“We were opportunity driven, and we stopped doing that,” adds Gustafsson. “We turned over every stone to scrutinise what we were doing. It was hard work for two years. We slimmed down quite heavily, and now we are more focused and efficient.”

If you don’t stay relevant, and you don’t find a way of creating a product or service that is helpful for the customer and creates value, loyalty and engagement then you are lost.

Bodil Eriksson Torp

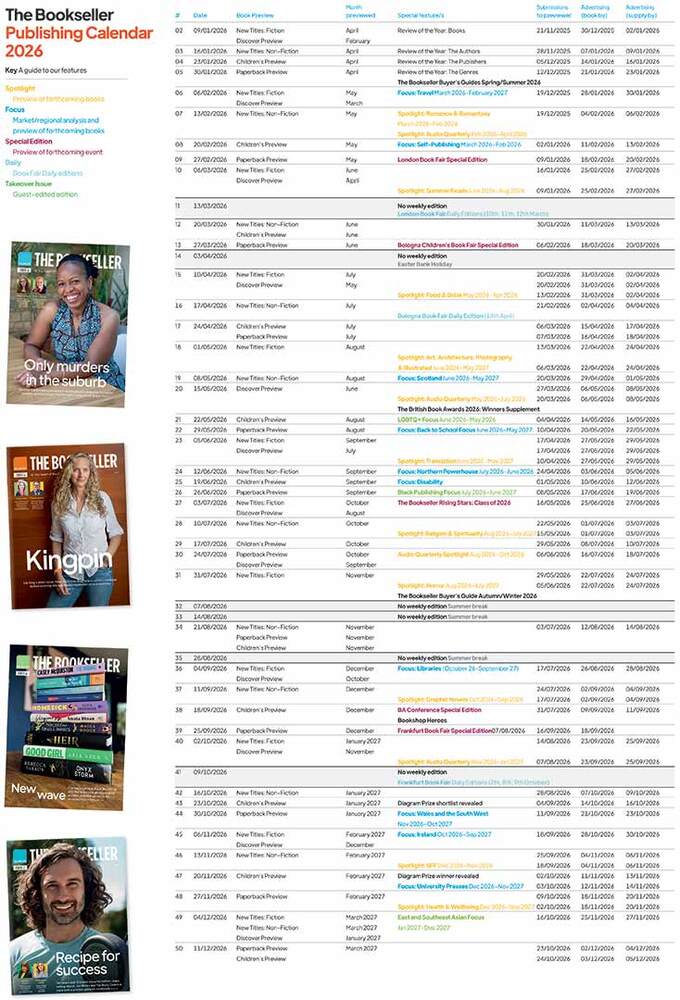

The hard work is evident in Storytel’s financial performance. Since 2018, Storytel’s sales had more than doubled, as had the number of employees, but losses, rather than diminishing, had also escalated. In 2023 the group made an operating loss of 742MSEK (£60m) but that became a profit of 246MSEK (£20m) in 2024, on sales that grew from 3,489MSEK (£275m) to 3,797MSEK (£300m). Its most recent half-year shows similar progress – operating profits of 137MSEK (£11m) on sales of 1,911MSEK (£150m).

In her financial comment, Eriksson Torp pointed to a “high subscriber intake, solid EBITDA growth and strong cash generation”, with churn at an “all-time low”.

The comment indicated that Storytel was now intent on digging in, not necessarily expanding out. Actually, Eriksson Torp insists both remain options. “We have a target of above 10% CAGR until 2028. That would come from both organic growth and acquired growth, with a high single digit contribution [for the former]. We are looking for acquisitions both in streaming and publishing, and in the markets we are active in already, ideally.”

In terms of expansion, there is an “opportunity in Europe”, says Eriksson Torp, but declines to give further details. “We have said it could be to open new markets, or re-open markets. We don’t say more than that. You’ll know more when we open.” Besides the core markets, Storytel also has operations in countries including Germany, Spain, Italy, France and India. In 2022 it was profitable in seven markets, today 23 out of 25 are profitable, she says.

The company is also keen to widen its customer reach within those markets in which it already operates. “In some of our core markets, we have not reached full potential, there are still people to attract,” says Gustafsson. “In some cases they haven’t found audiobooks yet.” In the Nordics, for example, its penetration is at just 10%, indicating the potential upside. E-books, via its subsidiary Mofibo, also remain an opportunity – particularly in the Nordics where audio tends to dominate – as do its publishing businesses.

Continues…

As part of its strategy the company intends to use its data better – to get at some of that potential – but also serve its current customer base more wisely. “I’m a really big believer that we can grow in the Nordics,” says Eriksson Torp.

There is also continued investment in new technologies, including artificial intelligence. In 2023, the business revealed an exclusive partnership with the AI speech software provider ElevenLabs to launch VoiceSwitcher, which allows listeners to switch between AI voices. “A lot of customers don’t listen to books they want to listen to because they don’t like the voice,” says Gustafsson. “There is still a resistance, but the tech is there.”

On developments in general, adds Gustafsson: “We’ve kept the start-up mentality when it comes to developing the service, so we are looking at things that are an obstacle for customers.” In terms of listener experience, the business also pointed to the implementation of Dolby Atmos spatial audio for its own Storytel Originals. It will also continue to invest in exclusive content as a way of differentiating its audiobook offer.

The business has also implemented its first ever “cohesive, group-wide strategy” that will see close collaboration and information sharing with its 11 publishing companies and its US subsidiary Audiobooks.com. Bought in 2021, it was then expected that the deal would result in a wider push into the US and other English-language markets. “To be honest there hasn’t been so much co-operating up to now,” says Eriksson Torp, but that will now change.

Crucial is the mix of financial models Storytel operates, built around its “foundational” streaming service that allows users in most territories to listen to as much as they want for a monthly fee, a template that up until Spotify’s launch of a limited version of this in the US and UK three years ago was eschewed by the big English-language publishers. When people talk about the Nordic audiobook “wonder” they are talking about unlimited streaming, says Gustafsson wryly.

Storytel has been shy about entering the UK market, partly because of the model it operates, but also because of the stiff competition from Audible (and now Spotify). Whether that will change under Eriksson Torp, she will not say. UK-based publishers already have relationships with Storytel through selling English-language audiobooks across continental Europe, so they have tried, even if they do not yet inhale. Simon & Schuster has recently rejoined the service, sending books one way. Whether the traffic will ever flow in the other direction remains moot. “We always have conversations, more or less,” says Gustafsson.

As a business that began as an outsider, Storytel is now very much on the inside – not just embedded in audio but also heavily invested in its own publishing, with revenue from that segment about one third of its overall portfolio, and currently outpacing the streaming division. With that in mind, Eriksson Torp talks as much about expanding the market for reading as about audio. “It’s about being relevant. If you don’t stay relevant, and you don’t find a way of creating a product or service that is helpful for the customer and creates value, loyalty and engagement then you are lost.”

“This is the game here,” she adds with emphasis. “Storytel has a really strong brand, and it is extremely important for us to deliver on that.” From those stealthy beginnings, this is a business with a story to tell.