Ice and spice: romance sales are running hot and cold as the year develops

Back in 2012, sales in NielsenIQ BookScan’s Romance & Saga subcategory peaked with 15,352,816 books delivering £68.2m. Those with long memories will know much of that was whipped up by EL James’ Fifty Shades trilogy; the three books made up a nice 69% of the category’s performance.

In the period that followed, the sector contracted to settle at roughly a third of that peak year. Yet after the Covid-19 lockdowns – the pandemic year’s figures are patchy due to data blackouts – Romance & Saga’s Total Consumer Market (TCM) hauls have grown, with volume averaging 10 million copies each year since 2022.

At first glance, 2025 seems to be a little alarming for those working within the genre: volume sales were down 15.4%, compared with the previous year, with value sales slipping 8.2%. However, that is due to 2024 providing the category’s second-best volume performance since accurate records began – and biggest value take ever – eclipsing 2012 by £1m. Last year’s 9.9 million copies sold still ranks within the category’s four best-ever years, with value holding strong; its £63.5m is beaten only by 2024 and 2012.

What will 2026 bring? It is very early days, but with flowers, chocolates and spicy books about hockey players being picked up in shops all over the country this weekend, it seems a perfect time to check in. So far this year, 800,794 copies have been sold in the category – which excludes Romantasy, these are in BookScan’s SFF genre – across nearly 15,000 different ISBNs. While that is an increase of 9.8% in the sheer number of titles, the quantity has dropped by 11.2%, although value has risen by 5.8% to £5.3m.

It means that the average selling price (ASP) across the category has risen by more than £1 in the first five weeks of 2026, compared to the same period in 2025. A small part of that increase is due to a better performance for hardbacks, but only a very small part. Hardbacks have increased by nearly a fifth, but Romance & Saga still lags far behind many of its Fiction sub-genres in this regard: the format’s total volume of 32,559 copies is only marginally more than just one mass-market paperback, Rachel Reid’s Heated Rivalry, which tops Romance & Saga with 29,262 units sold.

It is Reid where we need to look for our first clue as to what is driving the additional value. The TV series adaptation of the second book in the Game Changer series has taken Reid from a standing start to the category’s third-biggest author. The 44,201 copies she has shifted thus far in 2026 have an average selling price of £9.60 – a relatively low discount of 12.6% off the £10.99 RRP.

The first three Game Changers have amassed a total of £423,309, easily pushing Reid to the top of the ranking when sorted by value, outpacing second-placed Chloe Walsh by more than £160,000. That number would go up to an even greater £651,168 if books four to six in the series were added in, but for some reason they are currently recorded in the General & Literary Fiction sub-category. Expect those to have moved category before the end of the year to boost Romance & Saga. If that trio – Common Goal, Role Model and The Long Game – were added in, Reid would also top the volume chart, displacing last year’s number one and her fellow Canadian, Elsie Silver.

While Reid’s sales are all coming in with a high ASP, Silver is at the opposite end of the discounted stakes: the Chestnut Springs series – Silver’s bestselling titles in both 2025 and 2026 – all have ASPs with more than 70% off the RRP. While that is a steep discount, it is a higher ASP than this time last year. Total volume dropped 40.4% in the opening weeks of 2026, with value dropping 20.7% – which means an extra £1.13 has been added to the ASP of Silver’s titles.

Continues…

It is Reid where we need to look for our first clue as to what is driving the additional value. The TV series adaptation of the second book in the Game Changer series has taken Reid from a standing start to the category’s third-biggest author. The 44,201 copies she has shifted thus far in 2026 have an average selling price of £9.60 – a relatively low discount of 12.6% off the £10.99 RRP.

The first three Game Changers have amassed a total of £423,309, easily pushing Reid to the top of the ranking when sorted by value, outpacing second-placed Chloe Walsh by more than £160,000. That number would go up to an even greater £651,168 if books four to six in the series were added in, but for some reason they are currently recorded in the General & Literary Fiction sub-category. Expect those to have moved category before the end of the year to boost Romance & Saga. If that trio – Common Goal, Role Model and The Long Game – were added in, Reid would also top the volume chart, displacing last year’s number one and her fellow Canadian, Elsie Silver.

While Reid’s sales are all coming in with a high ASP, Silver is at the opposite end of the discounted stakes: the Chestnut Springs series – Silver’s bestselling titles in both 2025 and 2026 – all have ASPs with more than 70% off the RRP. While that is a steep discount, it is a higher ASP than this time last year. Total volume dropped 40.4% in the opening weeks of 2026, with value dropping 20.7% – which means an extra £1.13 has been added to the ASP of Silver’s titles.

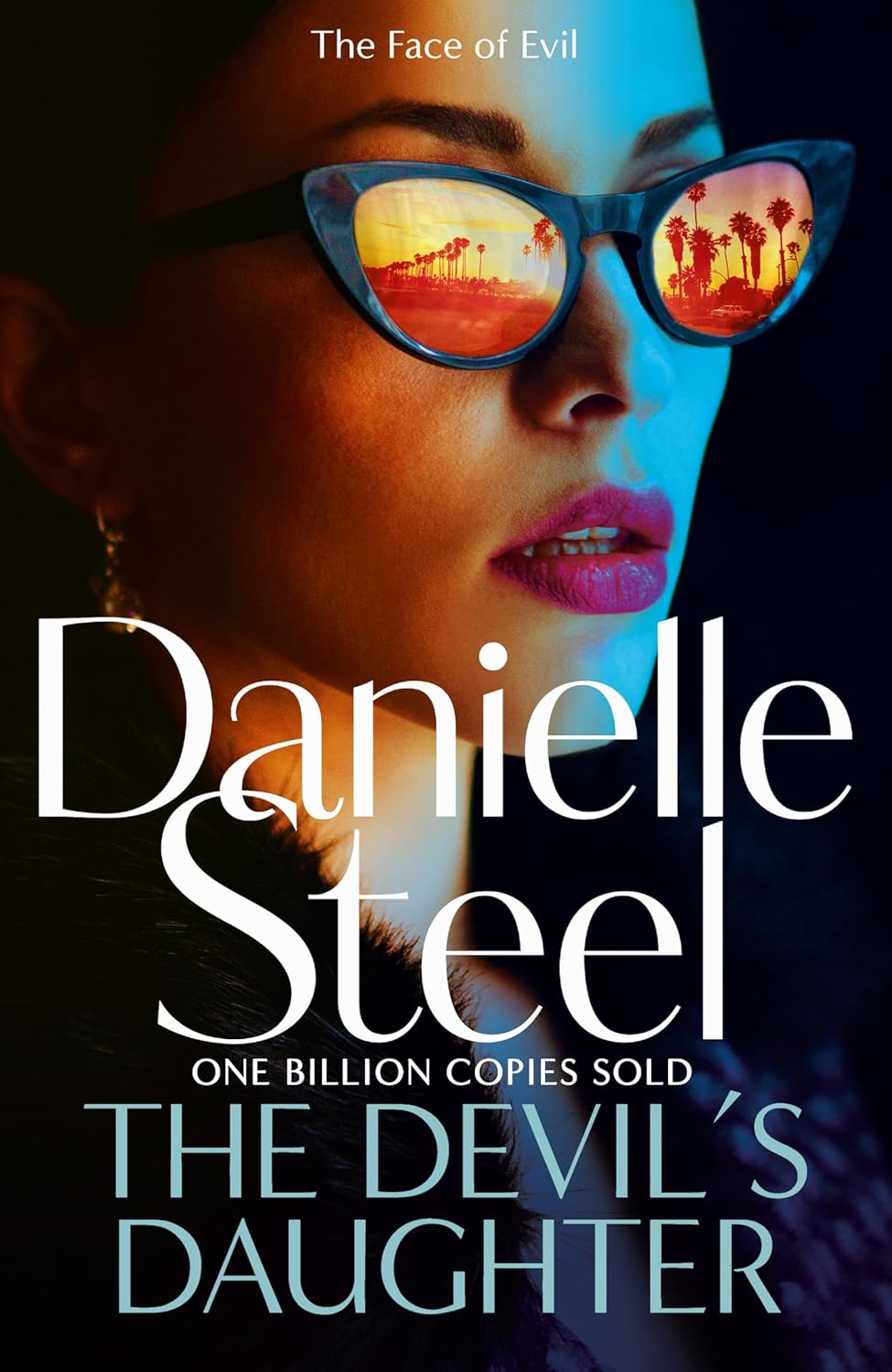

In the Spotlight

Danielle Steel

The Devil’s Daughter

Macmillan, £22, 9781529086102

While the likes of Elsie Silver and Rachel Reid represent a modern take on love, Danielle Steel represents a bastion of more traditional romance. The Devil‘s Daughter is the only hardback to feature in the Top 50 of the category so far in 2026; rewind one year and things are much the same, with Steel’s Never Say Never making the sole appearance for a hardback in the chart for the beginning of 2025. Sales are down 15% for the hardback, and Steel’s total performance has tumbled 40.8%.

TCM copies sold: 6,396